Making sense of the 2020 coin shortage

Coronavirus impact takes us one step closer to a cashless society

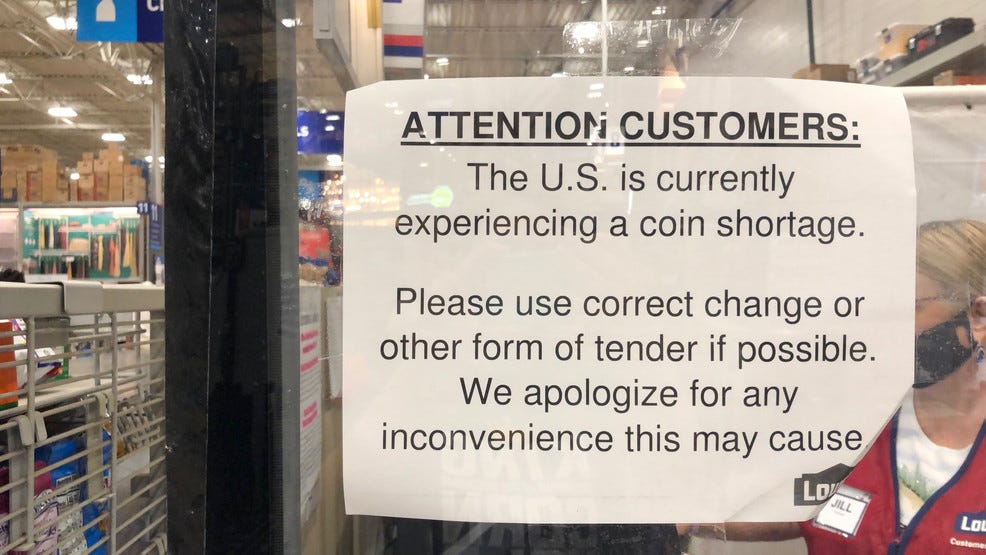

You’ve probably seen the signs asking for “correct change” at a favorite retailer. Or your bank has begun asking customers to exchange their coins for cash. It’s not just a regional phenomenon, but one that has become increasingly widespread across the United States.

Our nation is running low on coins.

First things first: don’t panic. It’s not time to hoard quarters or cash out your bank accounts. The present coin shortage is definitely real, but it is only temporary. It’s one of the unique by-products of the last few months as the United States has dealt with a global pandemic.

In June, the Federal Reserve made this announcement:

In the past few months, coin deposits from depository institutions to the Federal Reserve have declined significantly and the U.S. Mint’s production of coin also decreased due to measures put in place to protect its employees. Federal Reserve coin orders from depository institutions have begun to increase as regions reopen, resulting in the Federal Reserve’s coin inventory being reduced to below normal levels.

In case you don’t understand Fed-speak, let me translate it for you: In the past few months, people aren’t depositing as many coins in their banks. Also, the U.S. Mint slowed down its coin production schedule to protect its employees during the outbreak. Now that the economy is opening back up, banks are asking for more coins—and the Federal Reserve is running low on inventory.

Slowed production and slowed spending

A “perfect storm” of events starting in March led to this result. When businesses began to close down and states began to close during the start of the COVID-19 pandemic, the U.S. Mint made a strategic decision. They slowed down. They required fewer shifts of their employees. As a result, they churned out fewer coins than usual. (Yes, the Mint is always making more quarters, dimes and nickels and introducing them into broad circulation.)

At the same time, businesses that regularly help circulate coins also began to close, like laundromats and transit authorities. People stayed home and spent less money. Those who did make financial transactions tended to favor credit cards, because we were still trying to figure out if the virus spread through handling money.

Fewer new coins from the Mint combined with fewer coins being circulated the usual ways. So while the usual number of coins still exist in our economy—all those quarters haven’t just disappeared—they aren’t available where typically needed. Banks are running low. The Mint is still catching up on production. The pace of circulation is still slower than usual.

That’s why the Fed announced its “strategic allocation of coin inventories,” which sounds worrisome but is just a way to make sure banks and credit unions have enough coins to carry on with their daily business.

So while we’re waiting for the coin supply chain to get back to normal, businesses are asking for exact change. I view it like the toilet paper shortage in April. It was a big deal for a few weeks, but gradually it got better. When the economy reopens more broadly, the coin shortage will be an afterthought.

Controlling the flow of money

At least, that’s the secular story. Those of us who pay close attention to the Bible and to culture know that it’s important to look beyond the facts and consider how current events might apply to biblical prophecy.

“He causes all, both small and great, rich and poor, free and slave, to receive a mark on their right hand or on their foreheads, and that no one may buy or sell except one who has the mark or the name of the beast, or the number of his name.”—Revelation 13:16-17

This passage is a famous one referring to the Antichrist. After the rapture of Christians and during the Tribulation, the Antichrist will have military might, but his primary method of controlling the world will be through financial power. “No one may buy or sell except one who has the mark…of the beast.”

What will this mark be? We don’t know. But we do know it will limit your ability to conduct commerce of any kind, because the Antichrist will control the flow of money. If people refuse to receive the mark, they will be unable to transact business.

That’s why physical cash is important. As long as the world is reliant on coins and bills, it is impossible for any government, institution or individual to completely control the flow of commerce. But if someone can create a cashless society—one that relies more on data than on physical currency—then control can be maintained through a central, electronic data point.

Electronic commerce is one of the great conveniences of the times we live in. It’s the reason I’m able to sit in my office in Texas, enter the digits of my credit card, and buy a product being sold the other side of the world—even if I’m spending dollars and the product I’m buying is from someone who uses a different currency. The internet and our world’s interconnected, digital financial system make that possible.

Soon, the idea of “coin shortages” will seem like a quaint thing of the past, like rotary phones or even dial-up modem connections, because people won’t be using coins at all. And the more our financial society is inconvenienced by moments like this—for instance, having to provide exact change at the hardware store—the more we will move toward a cashless society.

It’s easier.

It’s faster.

It’s simpler.

But it’s also paving the way toward global financial control and the mark of the Beast. (I write a lot more about this in my new book, Tipping Point.)

The spirit of the Antichrist at work

Does this mean “good Christians” should only use cash or should avoid digital financial transactions or credit cards? No. Karen and I both have credit cards because they make our lives easier. We use them wisely.

But we also understand that the primary power the Antichrist will have over the world will be financial. And when we see large stories like this one about the coin shortage, we recognize that we may be witnessing the spirit of the Antichrist at work. Central banks have long been pushing the use of digital payments rather than old-fashioned currency. Many Americans—especially older generations—have been resistant to this, but I suspect today’s coin shortage may accelerate that societal shift.

Unique cultural moments bring about cultural change. We have reached an inflection point, and those changes are not moving toward the use of more cash and coins, but away from it.

When the times comes, those financial pressures will play into the plans and strategies of the Antichrist. Keep that in mind the next time you insert your credit card into the chip reader…or the next time you count out change at the hardware store.